Jodena Consulting Blog

The Next Chapter

April 24, 2018

I published my first blog post on July 26, 2009. I did this as an example to show my clients the significant SEO benefit they would receive by adding content to their website. Since that initial foray into Internet exposure, I have continued writing posts every 10 to 14 days for almost nine years. I’d like to share some thoughts and observations with you that I have learned from this project.

1. Don’t be afraid to try something new. I literally had no idea how to publish a post. I had never even heard of WordPress. The mechanics were daunting. But new technologies are only new until you get used to them. They quickly become routine.

2. Don’t be afraid of failure. I always think of the famous Japanese proverb that says “get knocked down seven times – get up eight!” To fear failure is an admission that you will most likely never accomplish anything of substance. Leaving your comfort zone has to become part of your DNA.

3. Rome wasn’t built in one day. Understand that it takes time and patience and a lot of hard work to achieve some level of expertise. Outliers: The Story of Success by Malcolm Gladwell chronicles the results of successful entrepreneurs who spend 10,000 hours to refine their skills.

4. Always remain open to new ideas and different approaches and continue to learn. So whether you want to add new clinical procedures to your practice, change the direction of your practice, downsize, upsize, relocate, expand or merge – just go for it. “Continuing to do what you always do but expecting a different result is the definition of insanity.” Albert Einstein.

5. Embrace mentors who can help you in your journey. There have been so many wonderful people that have helped me with the branding of my posts:

• Tim Healy of TNT Dental has been a friend since the day we started working together to build my first website. The man is a technical rock star and an Internet genius.

• My multiple grandchildren who seem to come out of the womb carrying an iPad and a cell phone!

• Seth Godin has been a true inspiration. Readers of my posts know how often I reference his wisdom. Seth is one of the most prolific and followed bloggers in the world. I read him religiously every day.

• Rich and Dave Madow are wonderful friends who have a well-deserved national reputation in the dental profession. They were most gracious to frequently mention me and my blog posts to their audience.

Now that I have hopefully inspired you to take on your next challenge, I did want to announce that I have decided to take a bit of a hiatus from publishing my posts. It may not be always apparent, but the average post – doing the research, writing and editing – takes me about five hours. My coaching and consulting business continues to grow, and I now find that I really need to devote more time to spend with clients.

So I will still reserve the right to weigh in with informative material or an opinion – but not on a regular basis. I want to thank you for your comments and useful feedback over these many years. Your support has been invaluable and thoroughly appreciated.

Second Visit Treatment Consultations for New Patients

April 16, 2018

I’ve spent the last four or five posts discussing the need for successful practices to integrate the process of scheduling more second visit treatment consultations as a surefire way to gain greater case acceptance. And I’ve tried to be very specific in stating that not all consultations are created equal. Precipitating event consults are handled one way, and cosmetic consults are handled altogether differently. I’d like to finish up this series by describing a third type of consult. This is used for presenting treatment plan choices to a new patient to the practice.

The scenario that I advise is for the doctor to greet the new patient in the Hygiene room when that patient has just been seated. This requires careful attention to detail and timing and is reinforced at the morning huddle. Introduce yourself – recognize a referral source – but do not perform any type of clinical exam at this time. Just a quick hello before the patient is put back into a reclining position. You announce you’ll be back to perform an exam when the hygienist finishes the necessary x-rays and the prophy is completed. You have no idea at this point whether the patient will need comprehensive treatment or minimal or no treatment.

If it turns out that there is little or no dentistry to be performed for this patient, a 10 to 15 minute exam by the doctor is usually sufficient. But if that new patient has necessary dentistry that would involve multiple appointments, then that patient should be scheduled for a complimentary 30 to 45 minute visit with the doctor to discuss treatment options. At that visit there will be a conversation regarding the timing of the treatment, the approximate cost of the treatment, and how best to maximize dental insurance benefits. For sure you need to ask the patient about their expectations. Do they have any fears or reservations. Staging treatment is most appreciated by the patient. You have to be very cognizant of not overwhelming the patient with a huge treatment plan.

The complimentary second visit for these new patients should ideally be scheduled within a week after their initial visit with the hygienist. This gives the doctor ample time to price out all the treatment options and investigate dental insurance benefits. It is impossible to do this kind of research at that initial visit. And the second visit is a nice opportunity for the doctor to develop a solid relationship with the patient and provide quality one-on-one personal time.

The moral of the story is to never forget the value of a complementary second visit. These are low pressure presentations in a relaxed atmosphere. Setting up these time blocks where you can give your individual attention to a patient with multiple dental needs will pay huge dividends in the form of the acceptance of quadrant and arch dentistry.

Cosmetic Consults

April 2, 2018

In my blog post of January 31, 2018, I recommended increasing second visit treatment consultations as one of the five strategies that successful practices need to implement in order to grow their profitability in 2018. And I’ve spent the last few posts talking about how to use these second visit consultations to gain greater acceptance of quadrant and arch dentistry specifically for precipitating events.

In my blog post of January 31, 2018, I recommended increasing second visit treatment consultations as one of the five strategies that successful practices need to implement in order to grow their profitability in 2018. And I’ve spent the last few posts talking about how to use these second visit consultations to gain greater acceptance of quadrant and arch dentistry specifically for precipitating events.

Today I want to discuss a totally different kind of second visit consult which is used to present cosmetic choices to patients who have indicated an interest in improving their smile. These patients would benefit from whitening, veneers, anterior crowns or bridgework or even orthodontic treatment like Invisalign or 6 Months Smiles. Case acceptance in these situations is going to be much lower than for a precipitating event. With precipitating events, since something must be done, case acceptance should be 90% or greater. With cosmetics, you would be a super star with acceptance of 25-30%. And that is because cosmetic treatment is elective.

The practice identifies which existing or new patient will be invited back for the consult based on the results of a cosmetic survey. You can copy this for your use – just add the name of your practice in order to personalize it. Target the daily Hygiene patients. Someone at your front desk hands out the survey on a clipboard or it could also be downloaded into a tablet. Once completed, a copy is made and put in a bin at the front desk and the original goes with the patient to their Hygiene room.

Anyone who shows interest is thanked for filling out the survey. No potential treatment is discussed at this visit. But acknowledgment is made by the doctor at the exam. “Thanks for taking the time to fill out the survey. We will get back to you to schedule a complimentary visit where I will discuss your needs and concerns and give you some ideas of possible treatment.”

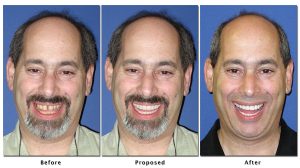

This second visit will take about 15-20 minutes of doctor time. Digital photographs are taken of the patient’s smile. The photos are sent out to be enhanced based on the patient’s expectations with your prescription regarding color, shape, and alignment. I like a company called SmilePix. They provide an excellent service. They email you a pdf enhanced image. You can then use a high quality color printer to make two prints – one for your records and one to give to the patient. The total cost to you for this is about $80. Contact Sam Laundon at 781-577-7700.

The patient will then be appointed one more time with the doctor for another 15-20 minute visit. They see with their own eyes what can be possible. A picture is truly worth a thousand words. You will have priced out various treatment options that are now presented to the patient. If one or two patients out of ten accepts treatment, the ROI for your time and materials is huge. I base this entire approach on the old saying that “if you throw enough spaghetti sauce against the wall, some of it will stick.”

If you have any doubts about even beginning this project, do yourself a favor. Look at and evaluate the responses of the first 100-200 surveys that have been accumulated in that bin at the front desk. I will bet you anything that 25-30% of your patients will have indicated some level of interest. These – and only these – are the patients that we are asking to return for the photos and then follow that up with treatment presentation. It is like playing cards with a loaded deck. These are people willing to listen to how you can change their lives. Based on my experience, your efforts will be well worth your time.

Give Yourself the Best Chance for Case Acceptance

March 14, 2018

In my last post I talked about what the doctor should say and do at a second visit precipitating event consultation. Essentially the doctor needs to present three treatment options and inform the patient of the approximate total fee along with an estimate of what dental insurance will pay for each treatment option. Once that has been completed and the doctor has answered any questions the patient may have, the doctor brings in the treatment coordinator and the doctor leaves the treatment room.

The treatment coordinator is the person to ask the patient which of the three options they would like to choose. I believe that patients are much more comfortable asking questions to someone they feel is more on their level. “What would you do?” is something you often hear from the patient when speaking with the staff member. That question provides the perfect opportunity for the staff member to tout the doctor’s clinical skills. “I know you will be so happy if you go forward with this because he/she is amazing and does really beautiful work.”

Patients are often intimidated by the doctor asking them what they want to do. And many doctors are much more comfortable letting someone else handle this request so that they are not perceived as being a sales person. So there is a double benefit with this approach.

The hoped for outcome is that the patient makes a choice, financial arrangements are made, and the patient schedules an appointment to begin treatment. With a precipitating event, this should happen most of the time. When that doesn’t happen, the treatment presenter needs to find out why. What is the patient’s concern about moving forward?

There are only three reasons for hesitation on the part of a patient to accept treatment recommendations for a dental situation that must be treated: money, fear, and time out of work. Using what is called the “objection formula” will be a big help in getting the patient to make a commitment. There are three parts to the formula. Part one is to agree with the patient’s concern. The second part is to rephrase the patient’s statement into a question. And the third part is to present the “what ifs”. Take a few minutes and listen to how this objection formula works.

Treatment acceptance for precipitating events should be in the 90% range. I hope my suggestions from these last few posts will help you to achieve that level of success.

Some Suggestions to Insure Case Presentation Success.

February 21, 2018

A week ago I wrote about preparing a patient for a second visit consultation. At that second visit, here are some tips to keep in mind.

1. Treatment presentation is done in a dental operatory and not in a separate consultation room. The patient is seated in the dental chair in the upright position- not lying down in what I would call a defenseless position. Eye to eye contact with the doctor sitting in his/her chair. I like the treatment room as opposed to a consult room because just in case you need to confirm something clinically, you can tilt the patient back to see something – and then return the patient to the upright position for your communication.

2. Your job prior to the consult visit is to design and price out three treatment options – the total cost along with the estimated insurance coverage if applicable for all three choices.

3. Don’t show the patient any x-rays. They have absolutely no idea what they are looking at. It took you two years of dental school to be able to interpret films.

4. Don’t draw squiggly lines on the bracket table cover. I don’t know why so many doctors do this, but it is a very ineffective way to describe or illustrate a procedure.

5. Instead, use photographs of perfectly shaded posterior and anterior crowns along with photographs of poor quality color crowns with gold margins showing in order to illustrate what “your” crowns will look like. When you talk about crowns, patients might have a negative perception based on what they have seen in other peoples mouths.

6. I love using an iPad to show clinical examples. The color is amazing and the experience is very interactive. (link to blog post)

7. Let the patient hold the study casts. Obviously the casts should be properly trimmed and cleaned and polished.

8. Use language that a 10 year old can understand. Do not use clinical words like margins, occlusion, etc. Talk about “cavities” and not “decay”. From the time kids are 3 years old, they know that cavities are a bad thing.

9. Present the three options for treatment. The sequence is to present the best option first – but we don’t call it the best. We say “one way, a second way and a third way.”

Now listen to how I present the three treatment options for a typical scenario of a precipitating event. Tooth #30 had a large amalgam restoration. The precipitating event was that the lingual cusp sheared off. Tooth #31 and tooth #29 are also restored with large amalgam restorations that are suspect but still intact. The patient qualifies for this 2nd visit because there is the possibility or potential to perform 2 or more indirect restorations in the quadrant where the precipitating event has occurred.

In my next blog post I will teach you how to close this case effectively.

Second Visit Treatment Consultations for a Precipitating Event

February 15, 2018

There are two kinds of precipitating events that are seen in your practice all the time. The first would be classified as an emergency – a patient calls because something is broken or is painful. The second would be a new or existing patient seen in the Hygiene room and the examination reveals decay or a periodontal problem. In both of these cases, treatment is required. There are negative and significant consequences to not performing treatment. Something must be done.

If the problem is isolated to a single tooth, the diagnosis is made when you see the patient, and the patient will be appointed for treatment. Usually there would be no need for a second visit to present treatment choices. BUT – If there is the possibility or potential for doing two or more indirect restorations within the quadrant or the arch where the precipitating event occurs – I recommend a no charge second visit for the patient to return to the office so that you have the opportunity to present choices. In dollars, that would be a minimum of usually $2500-$3000.

In preparation for that visit, take some diagnostic study casts, necessary x-rays and a few digital pictures – all at no charge – to help you prepare for the treatment choices you offer. You say to the patient “ Mrs. Jones – I want you to come back next week so that I can discuss your treatment options with you.” Now to the patient who has that broken tooth, or decay under an existing filling, they usually say “But Doctor – what are we going to talk about? I need you to fix my tooth.” DON’T say that we are going to discuss fixing those two other heavily restored teeth that are right next to the one that is broken. That NEVER works! And it does not work because the patient is distracted and concerned about only the tooth that is damaged. So they say “no doctor – let’s just fix the one that is broken.We can worry about those others later.” Because you try to present treatment choices at this initial visit, you fail and you end up being a one tooth at a time dentist – over and over again.

Instead, your answer to the patient when asked “what are we going to talk about” should be “you know, I am not sure. I want to study these x-rays and models and photographs to see why this happened – and when you come back, I will know your case by heart.” Those are the magic words! I learned them 25 years ago from the great Dr. Paul Homoly who was masterful at getting patients to say yes to treatment. I promise you those words are just as effective today as they were back then.

The only thing you do at this initial visit is palliative treatment – smooth a rough edge or put in a temporary sedative filling material. Take your photographs and study casts and re-appoint the patient for a 25 to 30 minute visit. Next week, I plan to send you a recording of a typical three choices of treatment presentation for a precipitating event. When you hear this, I hope you will be able to see the many positives of presenting treatment in this fashion.

Increasing Second Visit Treatment Consultations – Strategy #5 for Successful Dental Practices to Grow and Profit in 2018

January 31, 2018

People like choices. But people like to buy – they don’t like to be sold. You need to understand this concept when presenting dental treatment. Too often I see clinicians trying to present complex treatment at a continuing care examination in the Hygiene room or when a patient is seen for an emergency visit. We define treatment as being accepted when the patient has scheduled the first visit and has agreed to a payment option. Using this criteria, the results are poor – for many reasons:

• It takes time to analyze, price out, and plan out multiple treatment plans – how could you possibly do that effectively in five or six minutes? You can’t – and when you try, you mess up your schedule, the hygiene schedule, and you end up frustrated when the patient doesn’t agree or say okay.

• You do not have adequate time to understand or estimate dental insurance benefits that might be available and that might apply or not apply to treatment recommendations.

• You do not have time to review photographs or x-rays or diagnostic casts.

• If you do try to present a fee, the patient may often be overwhelmed with the costs.

So why do doctors act in this fashion?

1. Anxiety over filling an open time slot for treatment rather than investing in a “non-productive” half hour for discussion of treatment options.

2. Trying to strike while the iron is hot. Get the patient appointed quickly for fear that the patient might change his or her mind.

3. Dollar per hour production goals. Especially for associate doctors who are paid as a percentage of adjusted production or collections. When you invite a patient back for a 30 minute visit to explain treatment options, it is usually a no charge visit. Failure to recognize the value of time spent in this fashion is an incredibly penny wise/pound foolish approach.

All second visit treatment consultations are not equal. There are three specific situations and they all need to be handled differently.

1. Emergency treatment when palliative procedures were administered to relieve pain or discomfort.

2. Cosmetic treatments which most of the time are elective procedures.

3. New patient initial exams – either as part of a Hygiene appointment or as a first visit with a doctor.

Over the next few weeks, I will explain the strategies and details involved for all three situations. In my experience, the absolute best way to gain acceptance for quadrant and arch dentistry is by the utilization of second visit consultations. By definition, more acceptance of those treatment plans will increase growth and profitability in your practice.

Eliminate the Leadership Vacuum – Strategy #4 to Increase Growth and Profitability in 2018

January 24, 2018

In my daily telephone calls, physical meetings, or email correspondence, I hear a lot of complaining – both from staff members who are upset with management and doctors who are disappointed with staff behavior. Most of the time these complaints are the result of unrealistic assumptions or promises made but not honored. On further review, the issues can almost always be attributed to inadequate or poor communication between the doctor and the staff. And the larger the practice, the bigger the problem.

A Seth Godin post from a number of years ago has always resonated with me.” If you want to build a vibrant organization, the simple rule is: the rules apply to people in power before they are applied to those without. People might hear what you say, but they always remember what you do.” So understanding that the buck stops here, and that you as the doctor bear the ultimate responsibility for creating a wonderful workplace, what can you do to change the culture in your practice? Or more simply stated, how can you be a more influential and inspirational leader?

• Show up on time to begin the day. The first lesson of accountability is to lead by example. If you are continuously late, it shows disrespect for your patients and diminishes your credibility.

• Show empathy and generosity to your patient population. Patients don’t care how much you know until they know how much you care. We certainly want our staff to act in the same manner.

• Resist the urge to micromanage. Delegate to the extreme. Assign specific tasks and hold people responsible for their actions and the results. Allow people to fail and learn from their mistakes. You can’t do it all yourself – it is way too complex and way too much work.

• Avoid favoritism. When you consistently tolerate inferior performance with no repercussions, it makes you look weak and ineffective.

• Communicate your vision. Compliment and coach every day. Your staff needs to know that you appreciate them. Don’t assume that they know. Assumption is the lowest form of human behavior.

• Allow your staff to be more fully vested in the success of the practice. Try to include them in some of the management decisions in the office. Many times the best source of new ideas come from our staffs.

Above all else, you want to try to be a role model to your staff about how to live an exemplary life outside of the dental practice. I wrote a blog post about seven years ago that talks about imagining life as a game in which you are juggling five balls. The balls are work, family, health, friends, and integrity. You are keeping all of them in the air at the same time. One day you come to understand that work is a rubber ball – if you drop it, it will bounce back. But the other four balls are made of glass, and if you drop any one of these, it will be irrevocably scuffed or even shattered. Once you understand the lesson of the five balls, you will have the beginning of balance in your life. What a wonderful and positive message to share with your staff. That is true leadership.

This is the fourth in a series of five posts about how to create growth and profitability in successful dental practices in 2018. Final post – the need for increasing second visit treatment plan consultation appointments.

Consistent and Creative Internal Marketing – Strategy #3 to Increase Growth and Profitability in 2018

January 17, 2018

A key component of growth for successful practices is the acquisition of new patients – patients hopefully who appreciate good clinical dentistry and are happy and willing to pay for it.

This result is not going to happen by joining every PPO plan. It is not going to happen by offering free exams and free consultations to every bargain hunter. It is not going to happen by offering Groupon type programs- those kinds of approaches were an unmitigated disaster. And it is not going to happen by trying to compete on price – someone will always be willing to charge less.

Over the years, I have found the best source of quality new patients is referrals from your existing patient base. Word-of-mouth advertising is by far the most positive and effective and inexpensive way to market your practice. So how do you create the WOW experience that compels people to rave about you?

• An extraordinary customer service experience at every level with every interaction with every person in the office. This is easier said than done. The effort to achieve this needs to be continuous and consistent. Something that always gets people talking at cocktail parties is when they have received post treatment telephone calls by doctors and hygienists following difficult procedures.

• Rewarding patients for referrals. The greatest management principle in the world says that if you reward good behavior, you will get more of that behavior. So you certainly want to thank patients in meaningful and creative ways for the referrals of friends and family.

• Informing patients of how much you care. Every day we hear through the patient grapevine about someone in the practice who has suffered a tragedy – a parent, spouse or relative dying; someone who may be gravely ill; someone who perhaps lost a job. We also hear wonderful success stories – kids getting into the college of their choice, job promotions, or new business achievements. The magic of a short personalized handwritten note from the DOCTOR will bring a smile to the face of your patient. In the mind of the public, such behavior from a busy doctor’s office is unheard of. You will forever be marked “special”.

There is an old saying that relates to fee sensitivity. “Why pay the difference if you can’t tell the difference?” Accept the challenge to make it very obvious to your patients that your office is indeed different. Take every opportunity to let your patients know that you care.

It is impossible in a 500 word post to give all of the details and all of the specifics and innuendos of how to implement an effective Internal Marketing program. Please contact me if you are seeking more information.

This is the third in a series of five posts about how to create growth and profitability in successful dental practices in 2018. Next post –improving leadership skills.

Staying on Time – Strategy #2 to Increase Growth and Profitability in 2018

January 10, 2018

I firmly believe that the doctor is ultimately responsible for staying on time. No matter how perfectly crafted a schedule might be at the start of a day, it can all go to hell in a handbag if the doctor does not stick with the program. At the core, it becomes simply an issue of respect – an agreement and an understanding that the patient’s time and the patient’s life is just as important as yours. And I do find that people/patients will respect your time in direct proportion to the way you respect theirs. It has to become a major part of the DNA of the practice–we will stay on time!

I firmly believe that the doctor is ultimately responsible for staying on time. No matter how perfectly crafted a schedule might be at the start of a day, it can all go to hell in a handbag if the doctor does not stick with the program. At the core, it becomes simply an issue of respect – an agreement and an understanding that the patient’s time and the patient’s life is just as important as yours. And I do find that people/patients will respect your time in direct proportion to the way you respect theirs. It has to become a major part of the DNA of the practice–we will stay on time!

So what can a doctor do to consistently maintain an on –time schedule?

• Do not perform definitive therapy for emergency patients. While I strongly advocate that emergencies should be seen on the day of the call, the main goal should be to relieve pain or anxiety. Diagnose the problem. Get them comfortable, of course. And then reschedule for definitive therapy.

• Resist the temptation to present elaborate treatment plans in the hygiene room. This creates delays in both the hygiene schedule and the doctor schedule.

• Stop taking personal calls during business hours –from your stockbroker or a golf buddy. Totally unacceptable. And please don’t think that patients in treatment rooms are not aware of what is going on. When some-one is reclined in the dental chair and hears the doctor gabbing instead of paying attention to them, it is very aggravating.

• Do not agree to or allow a treatment schedule that you know is unsustainable or unrealistic. I could spend six hours discussing proper scheduling, but this is obviously not the place to do that. However the two most common scheduling errors that I observe are related to unbridled optimism: an inadequate time allowance for a known procedure, and an inadequate time allowance for a patient put in the schedule for an unknown procedure like a toothache or broken filling. Both of these situations almost guarantee that the doctor will fall behind.

• Be aware of the implications of bad judgment calls. This typically happens when a scheduled procedure is not progressing well. Maybe the patient was late, maybe an impression has to be repeated because the tissue was bleeding. There are a million examples. It’s important to know when to punt. Don’t mess up an entire morning or afternoon by stubborn determination to finish a procedure.

• Insist on a morning huddle. I find that practices that consistently use a huddle significantly increase productivity, reduce stress, and are way better at staying on time throughout the day.

There will be, of course, situations where despite your best efforts, you get behind schedule. If you can anticipate this, it is always a good idea to call a patient to let them know you are running late. This beats their sitting in your reception room waiting – and waiting – staring at the front desk person and looking at their watch. When you keep someone waiting more than fifteen minutes, they start mentally counting up all your faults! In this day and age where new patient flow is so key to success, be aware that it is unlikely that a patient will feel compelled to refer friends and family to your office when that patient is kept waiting. “Why further compound my problem and make this doctor even busier when he doesn’t even have time to see me!”

Above all else, take the stress out of your life. Stay on time. Everyone will be much happier.

This is the second of five posts on how successful dental practices can increase their growth and profitability in 2018. Next week’s topic – consistent Internal Marketing.